Create: Update:

The Week On-Chain, Week 15

The macroeconomic environment remains uncertain with the restructuring of global trade relations ongoing. In spite of this, the performance of hard assets remains remarkable with Gold surging to a new ATH of $3300 and Bitcoin residing above $80k.

Executive Summary:

🔹Macroeconomic uncertainty persists amid shifting global trade, driving volatility in U.S. Treasuries and equities.

🔹Bitcoin saw its largest drawdown of the cycle, but it's within bull market norms. Median drawdown remains far milder than in past cycles.

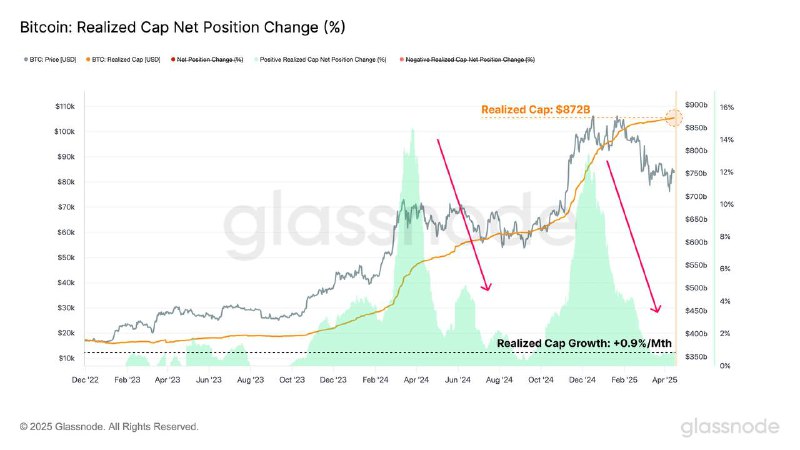

🔹Digital asset liquidity is tightening, with slowing capital inflows and flat stablecoin supply growth.

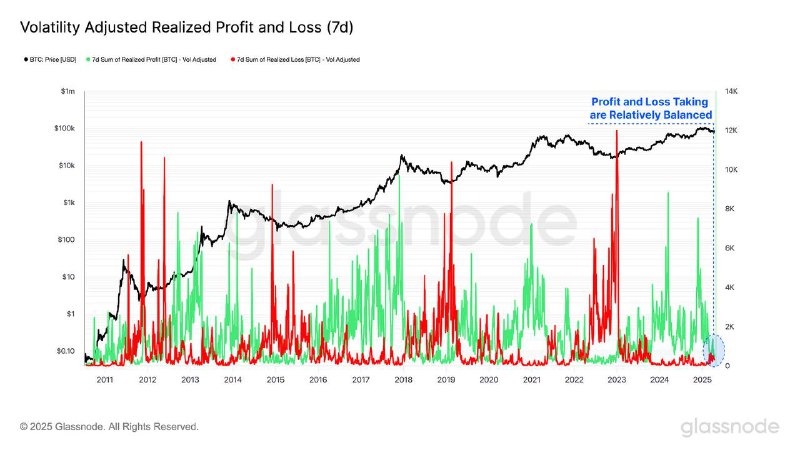

🔹Investors face record unrealized losses, mostly among new participants; Long-Term Holders remain largely in profit.

Read the full report here. Access the charts from this edition in a Glassnode Studio dashboard.

The macroeconomic environment remains uncertain with the restructuring of global trade relations ongoing. In spite of this, the performance of hard assets remains remarkable with Gold surging to a new ATH of $3300 and Bitcoin residing above $80k.

Executive Summary:

🔹Macroeconomic uncertainty persists amid shifting global trade, driving volatility in U.S. Treasuries and equities.

🔹Bitcoin saw its largest drawdown of the cycle, but it's within bull market norms. Median drawdown remains far milder than in past cycles.

🔹Digital asset liquidity is tightening, with slowing capital inflows and flat stablecoin supply growth.

🔹Investors face record unrealized losses, mostly among new participants; Long-Term Holders remain largely in profit.

Read the full report here. Access the charts from this edition in a Glassnode Studio dashboard.

The Week On-Chain, Week 15

The macroeconomic environment remains uncertain with the restructuring of global trade relations ongoing. In spite of this, the performance of hard assets remains remarkable with Gold surging to a new ATH of $3300 and Bitcoin residing above $80k.

Executive Summary:

🔹Macroeconomic uncertainty persists amid shifting global trade, driving volatility in U.S. Treasuries and equities.

🔹Bitcoin saw its largest drawdown of the cycle, but it's within bull market norms. Median drawdown remains far milder than in past cycles.

🔹Digital asset liquidity is tightening, with slowing capital inflows and flat stablecoin supply growth.

🔹Investors face record unrealized losses, mostly among new participants; Long-Term Holders remain largely in profit.

Read the full report here. Access the charts from this edition in a Glassnode Studio dashboard.

The macroeconomic environment remains uncertain with the restructuring of global trade relations ongoing. In spite of this, the performance of hard assets remains remarkable with Gold surging to a new ATH of $3300 and Bitcoin residing above $80k.

Executive Summary:

🔹Macroeconomic uncertainty persists amid shifting global trade, driving volatility in U.S. Treasuries and equities.

🔹Bitcoin saw its largest drawdown of the cycle, but it's within bull market norms. Median drawdown remains far milder than in past cycles.

🔹Digital asset liquidity is tightening, with slowing capital inflows and flat stablecoin supply growth.

🔹Investors face record unrealized losses, mostly among new participants; Long-Term Holders remain largely in profit.

Read the full report here. Access the charts from this edition in a Glassnode Studio dashboard.

>>Click here to continue<<

Glassnode